Blog Details

How Insurance Distributors Navigate AI and Regulatory Law Stay Compliant. Stay Competitive. Stay Ahead with Everinley.

As AI continues transforming the insurance sector, distributors face both new opportunities and new responsibilities. Today’s agencies use automated tools to streamline workflows—but they must also navigate strict regulatory requirements to ensure ethical and lawful use of AI. At Everinley, we help you leverage AI in insurance distribution while staying fully compliant with evolving industry laws.

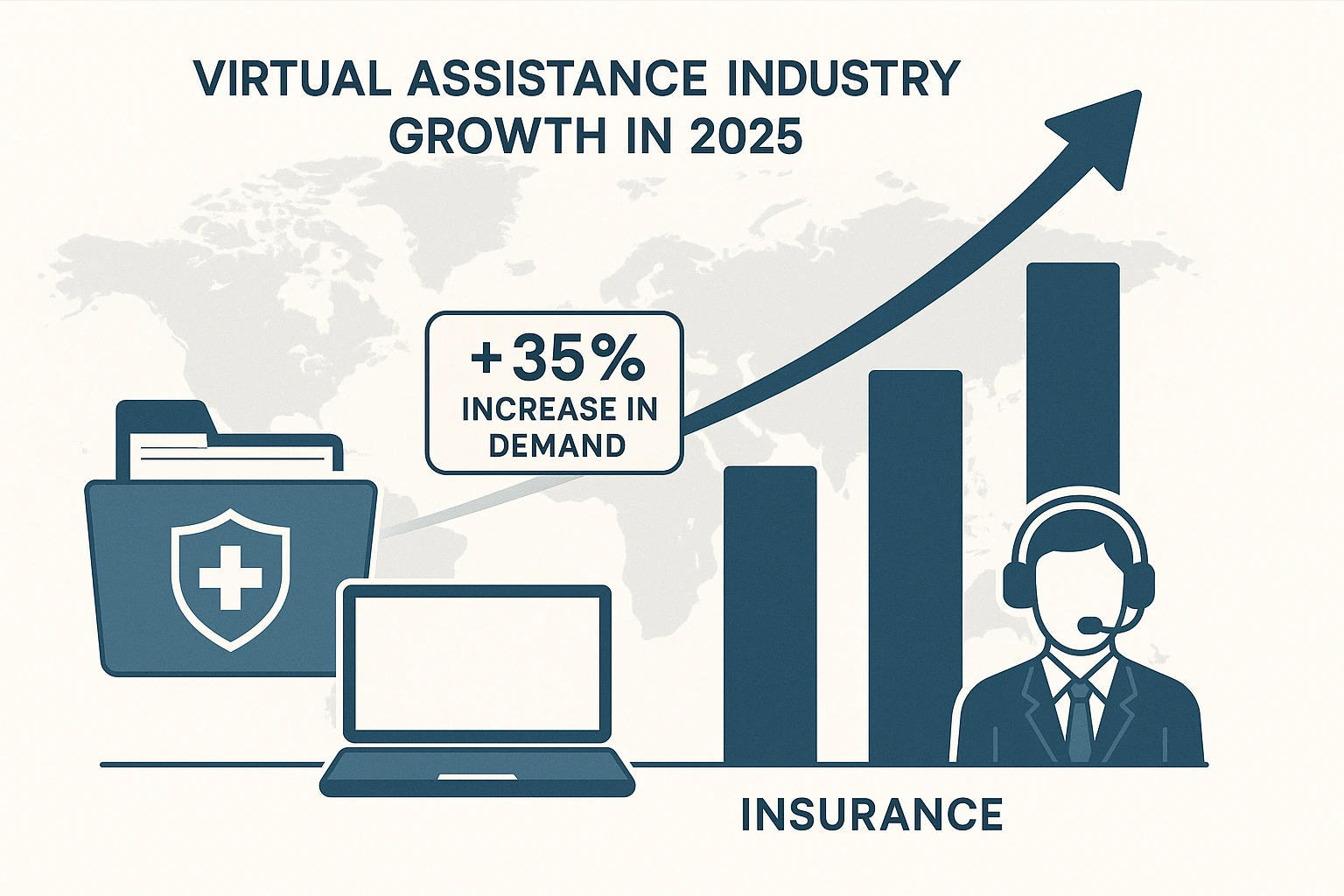

AI’s Growing Role in Insurance Distribution

AI-powered tools improve underwriting accuracy, automate workflows, and enhance the customer journey. With increased AI adoption in insurance distribution, agencies can operate faster and more efficiently.

However, automation introduces compliance challenges. Distributors must understand and prepare for:

-

AI compliance challenges for insurers

-

Data transparency rules

-

Fair and ethical use of AI

-

Oversight of automated decision systems

-

Everinley supports agencies in integrating AI responsibly without risking compliance violations.

-

Navigating AI Regulations in Insurance (2025)

The insurance regulatory landscape 2025 brings new rules around explainability, data handling, and consumer protection. Regulations now emphasize:

-

AI transparency requirements in insurance

-

Ethical and fair use of AI in insurance

-

Guidelines for AI-based insurance sales compliance

-

Stricter data privacy laws for insurance AI

-

Our team helps distributors understand and apply these requirements so their AI tools stay compliant at all times.

-

Regulatory Trends Insurance Distributors Must Follow

Everinley keeps you updated on major regulatory trends for insurance distributors, including

-

Stronger AI governance in the insurance industry

-

Monitoring through advanced insurance compliance technology

-

Requirements for unbiased underwriting models

-

Evolving frameworks for responsible AI in financial services

-

Key insurance distributor regulatory updates

-

With proactive compliance strategies, you can adopt new technology confidently and securely.

-

Managing Legal Risks of AI in Insurance

-

Using AI without proper oversight exposes your agency to risk. Common legal risks of AI in insurance include data misuse, algorithmic bias, and inaccurate automated decisions.

We assist you with:

-

AI risk management in insurance

-

Understanding insurance law and artificial intelligence

-

Implementing documentation and auditing

-

Ensuring consumer protection standards are met

-

Compliance Solutions for Modern Insurance Distributors

Everinley provides practical tools and strategies to maintain compliance while embracing automation:

-

Automated policy and regulation monitoring

-

Workflow auditing and system checks

-

AI fairness and transparency evaluations

-

Best-practice frameworks for insurance compliance best practices

Our solutions help distributors balance innovation with compliance without slowing down operations.

Future of Insurance Regulation and AI

As the future of insurance regulation and AI evolves, successful distributors will be those who adopt modern tools while respecting emerging laws. Everinley guides your agency through regulatory complexity so you can grow with confidence.